Small business owners, if you’re not already using Thriday, the next-gen financial management platform built for SMEs (small-to-medium enterprises), this announcement could push you to. The financial management platform built for SMEs (small-to-medium enterprises) launched a new interest-earning feature.

From August 19, 2024, all funds stored in Thriday transaction accounts will earn an impressive 3.35% p.a. interest rate (subject to change, T&Cs apply). Traditionally, businesses had to choose between earning interest and maintaining control over your funds. Using business savings accounts and term deposits meant sacrificing control, making it tricky to maximise financial earnings potential.

“Our new interest feature makes it easier and faster for small businesses to try and make a profit,” says Michael Nuciforo, CEO and co-founder of Thriday. “Every bit of extra money can make a big difference in today’s economic climate.”

Interest is calculated daily on all account balances and paid out at the end of each month. There are no special requirements or thresholds to meet and no restrictive terms — all funds stored in Thriday accounts are eligible. The platform’s AI-driven approach to automating banking, accounting, and tax further enhances its value, making it an indispensable tool for small businesses.

“Earning 3.35% interest across all my accounts is effortless and incredibly beneficial for my cash flow management,” says Lauren Deuble, owner of All Wrapped Up VA and Thriday customer. “With the amount of money I have coming into my accounts and the money I set aside for tax, the interest more than pays for my Thriday subscription.”

What Is Thriday?

Research conducted by Thriday found that small business owners waste an average of 42 days a year or six hours a week on financial admin tasks. And let’s not forget the cost of accountants — an average of $1,813 annually. But Thriday members are reporting a 60 precent drop in time spent on financial tasks like paying bills and reconciling transactions.

Thriday was born from the frustration of its co-founder, Ben Winford, who found his “to-do” list filled with financial admin tasks. The Thriday team recognised that better utilisation of banking data was the key to unlocking the pain points for small business owners.

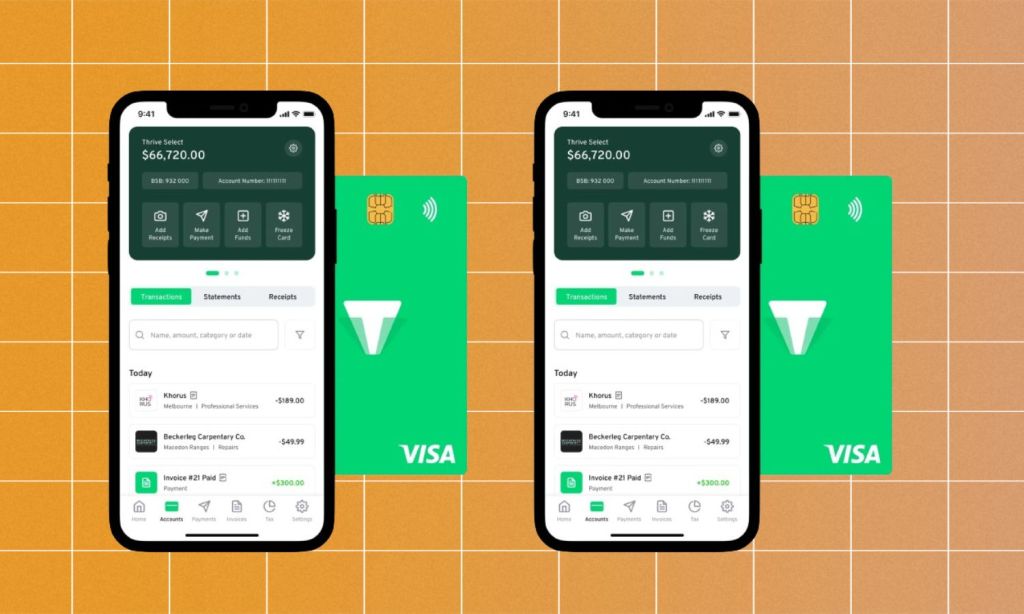

With Thriday, as customers transact and receive payments, the data is categorised and fed into the Thriday bookkeeping engine. This means the appropriate accounting calculations and deductions are determined in real-time, eliminating the need for an accountant.

“It’s ironic because accounting software, such as Xero and MYOB, relies on data from your bank to determine your profit and loss and income statement,” says Nuciforo. “Then your bank relies on accounting data to decide if they want to lend to you. The underlying data, your transaction data, is the same.”

“Because we can determine exactly what transaction has occurred, what GST was added, and what tax implications it has, then we can automatically calculate your tax, BAS and cashflow position. It’s like having a personal financial assistant.”

In a survey of 250 Thriday customers, 85% agreed that managing their banking, accounting, tax, and payments in one place is much easier. And 66 percent said they would be “extremely disappointed” if they couldn’t use Thriday. It’s like having a personal financial assistant, right in your pocket.

Thriday has partnered with Regional Australia Bank and Visa to offer banking-as-a-service, so you can trust that your funds are safe and secure.

Read more stories from The Latch and subscribe to our email newsletter.