A few months ago, NFTs were absolutely everywhere. Now, not so much.

In case you’re still a little confused, NFTs are unique digital collectables. They are ‘non-fungible,’ meaning they are not able to be copied and transferred as their authenticity and one-of-a-kind nature is guaranteed by the algorithm of the unchangeable Ethereum blockchain.

As the blockchain is public, i.e. online, it can’t be secretly altered and, as it always moves forward in time, one piece of code, whether that’s a song or an artwork or a picture, is forever stamped into it. Think of it like a turning gear, stamping information into a connected chain that everyone can see.

The technological breakthrough of being able to buy and sell digital work that has its authenticity and uniqueness guaranteed is huge. It means there will only ever be one of a thing and therefore, it becomes collectable, rare, and expensive. Anything that can be transmitted digitally can be an NFT and its a tool that has finally been able to give artists and creatives fair pay for their works.

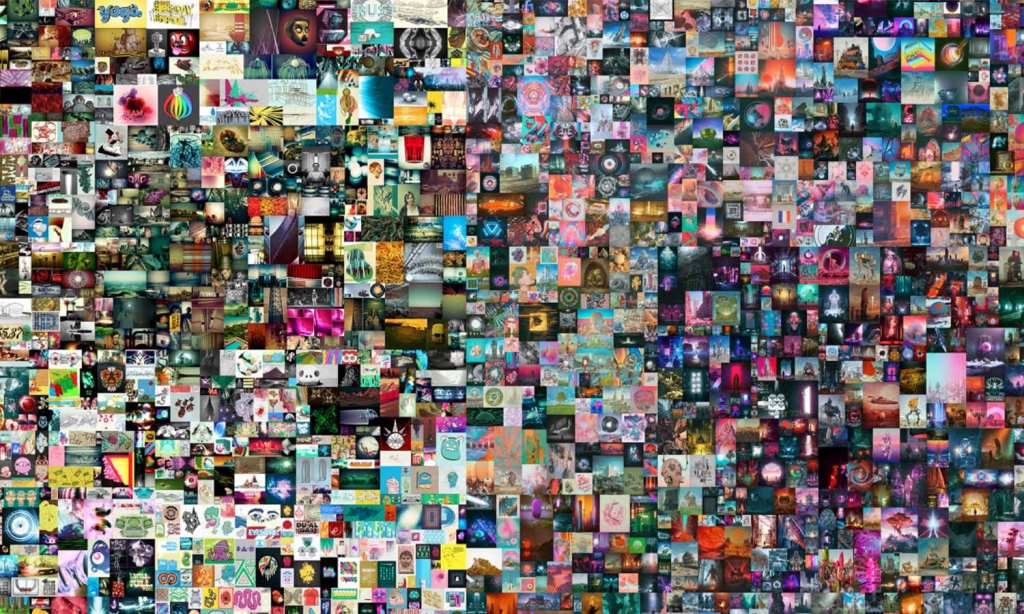

The whole NFT culture comes from the highly nerdy, ironic meme culture surrounding the blockchain and the internet. As many NFT proponents are cashed-up cryptocurrency adherents, the prices for these tokens skyrocketed. In March, relatively unknown American digital artist Mike Winkelmann AKA Beeple, sold an NFT for $69 million. The price is not an accident, as those bidding in the auction are deeply devoted to silly jokes and sexual innuendo.

In June, Guardian technology correspondent Alex Hern warned that the NFT craze was deflating from its March high. He suggested that the sale of the internet’s source code by its inventor Tim Berners-Lee ought to go for more than the Beeple artwork, given that it’s a seriously important cultural document and one that could only be sold as an NFT.

It sold for $5.4 million, prompting Hern to suggest that the craze was finished. This is not to say that NFTs are done however, far from it. Like all blockchain-associated technology, these things come in waves, lifted by hype and hysteria.

We caught up with Ray Brown, market analyst at CoinSpot, an Aussie-based cryptocurrency exchange where you can buy and sell Bitcoin, Ethereum, Ripple, and over 300 other digital currencies.

He explained a little bit more about the NFT hype and what you need to know as the next wave approaches.

The Latch: Can you explain the huge rise in NFTs we saw over the past few months? Where did that come from and why?

Ray Brown: The NFT market has really transformed over the past year, as more everyday Aussies are getting involved in the hype and renewed interest in crypto. What started as an Internet hobby among a certain subset of tech and finance nerds has now been catapulted to the mainstream.

The many applications of NFTs and the adoption from some of the world’s biggest digital and traditional artists, sporting heroes and celebrities have been one of the major catalysts of its widespread adoption.

The growing interest in NFTs has resulted in record-breaking trading volumes during the month of August, with individual sales exceeding more than USD$1 million dollars on a regular basis.

TL: The hype has certainly died down around NFTs – does this mean they’re just a fad or will they continue to be a genuinely important part in the way businesses and creatives work?

RB: While the hype of NFTs may have cooled a bit since the start of 2021, the interest in NFTs is still alive and well. The main reason for this has been due to the amount of major companies jumping on the NFT bandwagon in recent months. In addition to this, major projects are still hitting/hovering around all time highs such as CryptoPunks, Cool Cats, Bored Ape Yacht Club and Creatures.

As blockchain technology reaches new heights in terms of adoption, it’s expected that NFTs will soon be traded and auctioned just like any other traditional asset or masterpiece. NFTs have the potential to vastly alter our relationship with the digital world by introducing object-based verifiable digital scarcity.

TL: What’s next? Will we see a bit of a lull in public awareness as the tech gains adoption in the background before another big resurgence?

RB: It’s hard to say. There are multiple projects being released almost daily, so it’s unlikely that the interest will completely decline. Many big companies have some exciting applications in the works, and many investors are guessing only time will tell before there’s another big NFT boom.

TL: Should people be investing in NFTs and if so, what are some of the most exciting areas right now?

RB: Investors should only invest in NFTs, and really any asset, if they understand the asset class and whether it is appropriate for their risk appetite. Like any asset, NFTs can be volatile, so investors should keep an eye on the news to ensure they make the right investment decisions.

There are plenty of exciting (and random) projects in the NFT space, especially within the gaming, music, luxury fashion, sport and collectables spaces.

Burberry, for example, recently launched some gaming NFTs. The luxury brand partnered with game-technology studio Mythical Games to launch the NFTs, known as “The B Series” within the studio’s flagship game “Blankos Block Party”. The multi-player game features digital toys known as “Blankos” that live on a blockchain. As part of the collection, Burberry has launched in-game NFT accessories which players can apply to any Blanko they earn.

Down under, Aussie DJs, Flight Facilities collaborated with design studio Babekuhl in August to give away a series of limited edition NFTs across Sydney, London and Los Angeles. This release was developed to celebrate Flight Facilities’ new “Never Forever” mixtape.

Another interesting recent NFT project came from famous British artist Damien Hirst in July. Hirst developed “The Currency”, which is essentially a collection of 10,000 NFTs which correspond to 10,000 physical artworks stored in a secure vault. The collectors will not be buying the physical artwork immediately. Instead, they pay USD$2,000 for the NFT and then have a year to decide whether they want the digital or the physical version. Once the collector selects one, the other will be destroyed.

Read more stories from The Latch and subscribe to our email newsletter.