Aussie renters, around 32% of us or some 2.6 million households, are expected to be hit with severe rental increases as international borders open.

This is according to experts surveyed as part of Finder’s RBA Cash Rate Survey who say that the lack of demand for housing caused by the pandemic is about to be reversed, driving up demand and subsequently rent as landlords once again find themselves in a position of power.

At the start of the pandemic, back in March of 2020, rents dropped significantly across the nation as international students, tourists, and backpackers left Australia. This saw landlords having to cut rents and offer incentives to their tenants in order to retain them and assist in financial hardship situations.

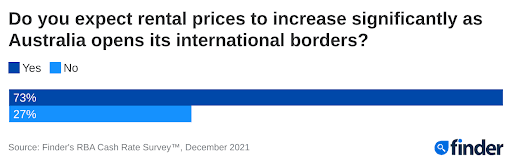

In this month’s Finder survey, 37 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy. While all panellists expect a cash rate hold in December, the majority (73%, 22/30) who weighed in expect rental prices to increase significantly as Australia opens its international borders.

Graham Cooke, head of consumer research at Finder, said renters should start preparing for higher housing costs.

“The pandemic turned the rental market on its head in some areas, with vacancy rates increasing in major capital cities like Sydney and Melbourne. As international students and backpackers return to our shores, we’re going to see demand quickly flow back,” Cooke said.

Experts Split on Rate Rise Next Year

While there is no expectation that the cash rate will increase before the year ends, almost half (46%, 17/37) of all experts expect a rate increase in 2022.

The cash rate is the rate at which banks borrow money from each other for short-term loans and is set by the Reserve Bank of Australia. The RBA set the cash rate at a historic low of 0.1% during the pandemic but this could rise next year, having a big knock-on effect for interest on savings, mortgages, and the international exchange rate.

Cooke said there had been a seismic shift in expectations for a rise in 2022.

“Only a few months ago, there was little expectation of any movement until 2023. Now half of the experts are predicting a rise next year.”

Nicholas Frappell of ABC Bullion said despite multiple risks through 2022, he was still leaning towards an earlier-than-expected tightening.

David Robertson of Bendigo Bank said with economic recovery underway, together with rising inflation, we’ll see pressure on the RBA to increase official interest rates by next December.

“Although there is uncertainty around the new Omicron variant – assuming vaccines and boosters are effective for Omicron, the recovery should continue and higher rates should be expected through financial year 22/23.”

More than two-thirds of experts (71%, 22/31) expect to see lenders raise their interest rates out of cycle before the RBA increases the cash rate.”

Those who think their rate will stay low just because the cash rate is holding would be wise to be prepared for an out-of-cycle hike,” Cooke said.

Housing Market Unlikely to Deflate in 2022, but Employment and Wage Growth Look Strong

Finder’s Economic Sentiment Tracker gauges experts’ confidence in 5 key indicators: housing affordability, employment, wage growth, cost of living and household debt over the next 6 months.

Both housing affordability and cost of living have seen month-on-month declines.

Cooke said while there had been some forecasts of price drops in 2022, Finder’s panel was largely in disagreement.

“Over 80% of experts think it is unlikely that property prices will fall by 5% or more next year, as has been suggested in some quarters. Expect a robust but unspectacular 2022.”

Not only will property values continue to rise, albeit perhaps more slowly, rental prices are also set to jump significantly.

“Additionally, positive economic sentiment towards employment is now the highest it’s been over the last 12 months, sitting at 77%.

Cooke said that a surge in positivity around employment and wage growth over the last few months shows confidence in the jobs market.

“This shows experts are confident that lockdowns are behind us and the jobs market could be set to heat up.” Opening of international borders will be a big factor here,” Cooke said.

Read more stories from The Latch and subscribe to our email newsletter.