How do you feel about this statement: “How and what I choose to do with my time in the future, should be purely up to me and not up to anyone else”.

If you’re yelling “hell yeah!” (in your head), then keep reading.

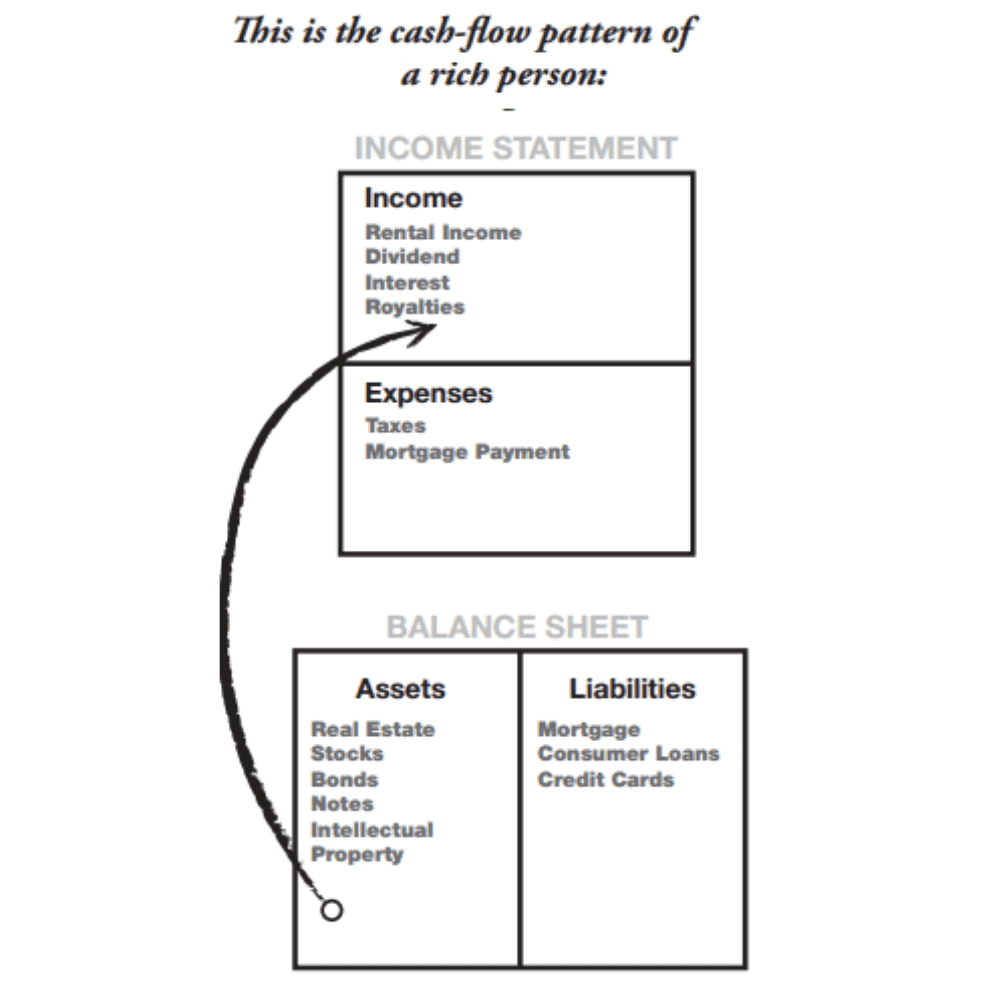

To truly be the captain of your ship, and master of your fate, you want to build up enough assets in your personal balance sheet, so that the income it produces will cover all your expenses. See the graph below for a better understanding.

At that point, you’re truly independent and can pursue whatever the heck you want. Imagine, you’re going to a job not because you have to, but because you want to.

This is where frugal living comes into play. The more you can save, the more you can invest and build your assets column, and the earlier you can retire.

So in this article, I am going to share with you the 5 practical frugal living tips that enabled me to save up to 60% of my monthly paycheque.

Now, I just want you to know that I worked my way up to 60%, and I am saving so much because I don’t want to retire at 65 — I want my independence back at 35, and I have 7 years to get to my goal.

Not all of these tips are for everyone. Use this as a source of inspiration, try those that interest you, and keep what works.

1. Avoid expensive areas to live

“It’s cheaper to live in the city because I don’t want to pay for transport and can walk to work,” you may have heard yourself say. But news flash, living in the city is expensive. Much more expensive than public transport.

I get it, you want to go to awesome bars, eat at a great restaurant, be adventurous and YOLO. Sounds great, but you could instead accumulate enough assets so that you can eat at whatever restaurant you want and never check your bank account again.

My advice? Do your calculations and see if it’s actually cheaper for you to live in the city or live just a little bit further away from the city.

2. Your surroundings matter

This is going to sting a little, but bare with me. The top five people you surround yourself with will be a significant contributor to you being financially independent earlier or at 65.

If you’re trying to live frugally to reach financial independence earlier in your life, it’s hard to stay on track when you’re surrounded with people who wave their credit card in the air like they just don’t care.

To them, it might seem like you’re being cheap and not living life to the fullest, but to you, bring frugal with your money is an investment in your future self.

So ask yourself, does my physical environment and my friends/family support my mission of frugal living for early retirement?

If the answer is anything besides yes, then I’d urge you to consider spending more time with people who have goals similar to you.

3. Say goodbye to expensive habits

Expensive habits, especially the ones that are destroying your health, are some of the bigger hurdles in frugal living to early retirement.

They seem to be bigger hurdles because you’re so used to enjoying them, and that instant gratification just feels so good.

I don’t need to tell you how expensive it is to keep those habits, not to mention the potential for expensive medical bills that come with it later in life.

But imagine reducing your consumption of it, slowly. Then by reinvesting that money either in yourself or in building your assets, you’re ultimately regaining future independence.

The choice is yours.

4. Limit your discretionary spend on credit cards

Credit cards are a great way to manage your cash flow, especially in tough times, but you should never wave your credit card in the air like you just don’t care.

Those high-interest payments are literally the biggest waste of money since it just eats away your wealth, instead of helping you build it.

If you can’t afford something with your money yet, ask yourself: “do I really need this right now?”

I can promise you that a sale is not going to end, and that limited edition really isn’t that ‘limited’.

Trust me, I know, because I am usually the one running marketing campaigns to persuade you to buy RIGHT NOW.

5. DON’T ‘buy now, pay later’

It’s so easy to have the latest and greatest of everything for just a small monthly payment. But just because these ‘buy, now pay later’ services say they’re free, does not mean they are.

There are set-up fees, maintenance fees, and extreme high-interest rates after the interest-free period.

My problem with ‘buy now, pay later’ services is that the purchase is almost too frictionless. It’s too easy.

And then the next thing you know, you’re drowned in hefty monthly payments, so much so, that you’re forced to work in a job you don’t love to pay for things you barely like.

That right there, is you giving away all your future independence.

Final thoughts

All these frugal living tips are to help you regain control of your independence, but you need to understand why you are going down this path in the first place.

Call me a control freak, but I want to truly be the captain of my ship and the master of fate, and not at 65. Frugal living is a key ingredient for me to achieve that.

So, what do you want?

David Quan is an entrepreneur and content creator on the pursuit of financial independence. Check out his YoutTube channel for more tips and advice for achieving financial freedom.