It’s happened, again. And by again, I mean it’s the fourth time in a row interest rates have bumped the heck up. As of July 2, the Reserve Bank of Australia has increased interest rates 50 basis points from 1.35% to 1.85%.

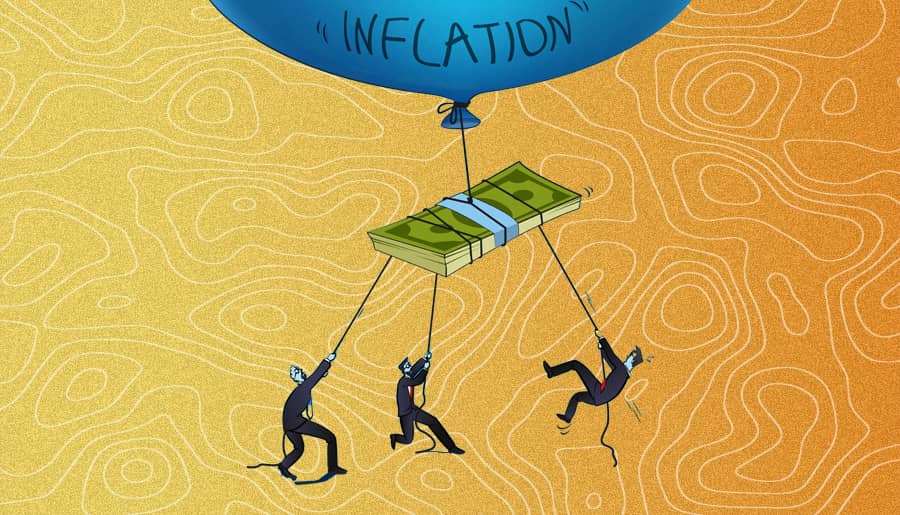

“Inflation in Australia is the highest it has been since the early 1990s,” explained Philip Lowe, Governor of the Reserve Bank of Australia. He also said acknowledged that this situation is far from ideal, saying, “The Board is committed to doing what is necessary to ensure that inflation in Australia returns to target over time.”

Will the Interest Rates Rise Impact Homeowners?

This increase won’t be pretty for those who have a mortgage. “This latest hike could cost the average mortgage holder a whopping $7,300 extra per year compared to what they were paying in April,” explained Finder’s Head of Consumer Research, Graham Cooke. He also stated, “With almost a quarter of Australian homeowners already struggling to pay their mortgage in July, this news will be especially painful.”

Moreover, to make matters worse, we are currently going through a rough-as-guts cost of living crisis. “Rising interest rates, soaring inflation, energy prices, and the general cost of living are already squeezing household budgets,” noted Cooke.

Related: Cost of Living Rebates — State-by-State Guide

Related: House Prices Are Dropping and Rent Prices Are Rising

But Why Is the Interest Rates Rising Again?

If the price of stuff becomes too high, nobody can buy anything, and then the market crashes. Thus, some experts are hopeful that by upping the interest rates, less stuff will get bought, and then the price of that stuff will drop to become reasonable again. The Reserve Bank of Australia’s bump might help us from car crashing into a recession or a depression.

Additionally, Ord Minnett’s Malcolm Wood said, “Rate rises will absorb the elevated saving rate, reverse the wealth effect, and cap the amount of excess saving spent.”

A similar sentiment was also expressed by Laing+Simmons’ Leanne Pilkington. She asserted, “It’s reasonable to believe increased mortgage repayments for a large number of Australians will affect spending over time, with a reduction in spending already being seen.”